Speak Out CNY Marks 6-Month Scamiversary of Katko’s Vote to Pass the TrumpTax

SPEAK OUT CENTRAL NEW YORK MARKS SIX-MONTH ANNIVERSARY OF KATKO’S DEVASTATING VOTE TO PASS THE TRUMPTAX

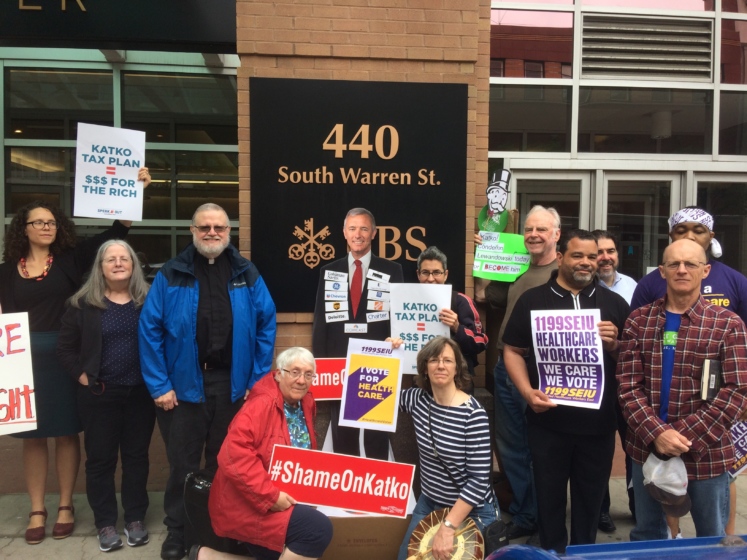

CNY Solidarity, Indivisible Syracuse, 1199SEIU Healthcare Workers and More Joined Speak Out CNY To Emphasize Punishing Result Of Tax Scam For Working Families

SYRACUSE — Speak Out Central New York and its allies today marked the six-month anniversary of Congressman John Katko’s vote to pass the TrumpTax with a press conference outside Katko’s Syracuse office, reminding Central New Yorkers that Katko voted to pass a Republican tax scam that overwhelmingly favors the rich and punishes working families.

“Last December, with no public hearing, Congressman Katko voted to pass the disastrous TrumpTax, raising New Yorkers’ health premiums by an average of $572 and even more for families,” said Rev. Steve Plank, a retired minister from Syracuse. “I’m alive today because eight years ago, thanks to the health insurance that covered me despite my pre-existing conditions, I was able to have a critical surgery. Everyone deserves access to that quality of health care – it is a human right. Congressman Katko should be an honest representative for his constituents, and stand for the well-being and health of all of us.”

Katko’s support for the TrumpTax will cause New Yorkers’ taxes to increase by $2.4 billion in 2019, while offering corporations and the rich billions in tax breaks. Since the TrumpTax passed, just 4.3 percent of workers nationwide have received a bonus or wage increase, despite Katko’s demonstrably false claims that the bill is spurring wage hikes for workers.

The tax scam also included a repeal of the individual mandate, which is expected to spur double-digit premium hikes for New Yorkers. Some New York insurers have requested rate hikes of as much as 38.6 percent for 2019, meaning even higher costs for working families. At the same time, a coalition of Republican-led states are attempting to use the individual mandate repeal to undermine other protections for patients, leaving 600,000 Central New Yorkers at risk of losing their coverage because they suffer from pre-existing conditions.

With news of a potential “round two” of the tax plan set to emerge in the next few months, Katko’s constituents could face “even more tax cuts to high-income Americans, causing long-lasting damage to the federal budget, and further threatening priorities such as Social Security, health care, and education.”