ITEP Report Proves Trump Tax Sends Vast Majority of Benefits to Richest Americans

NEW REPORT CONFIRMS TRUMP TAX PLAN SENDS VAST MAJORITY OF BENEFITS TO RICHEST FRACTION OF AMERICANS

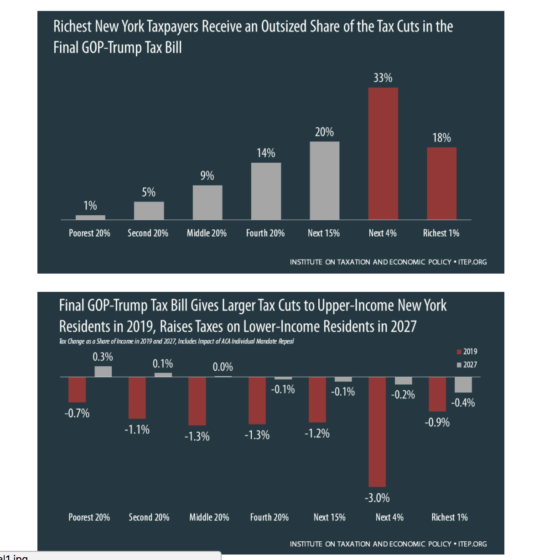

Report From ITEP Shows Richest 20 Percent Of New Yorkers Will Receive 68 Percent Of Tax Cuts

SYRACUSE – A troubling report from the Institute on Taxation and Economic Policy released this week shows the richest 20 percent of New Yorkers will receive more than two thirds of the benefits of the recently-passed Republican tax plan, even as congressional Republicans consider making permanent the supposedly temporary tax cuts for the richest Americans.

“This report simply proves what Central New Yorkers, and all Americans, already knew to be true: the Republican tax plan passed in December is nothing more than a way to funnel even more money away from the poorest Americans and into the coffers of wealthy donors and rich corporations,” said Amy Fleming of the Southern Tier Catholic Peace Community. “Congressman Katko and Congresswoman Tenney voted for this plan even though they knew that only the richest fraction of New Yorkers would benefit, and come November, voters will hold them responsible for raising costs for New York families by an estimated $2.4 billion in just 2019 alone.”

Under the existing Republican tax plan, the bottom 60 percent of America receives just 14 percent of the tax benefits. If the tax cuts for the richest Americans are extended, that number drops to just 12 percent. Here in New York, 8 percent of the the bottom 60 percent of New Yorkers will see a tax hike, instead of a cut. If the extensions are implemented, that number goes up to 11 percent.

Meanwhile, the richest 1 percent of New Yorkers are seeing an average tax cut of just under $20,000 – an average savings totaling more than the average savings of the other 99 percent of New Yorkers combined.

The Republican tax plan already pools a staggering majority of benefits with the richest individuals and corporations, and the extensions now being proposed promise to only continue that inequity by spurring tax hikes for other Americans over the next decade.

The full ITEP report can be found here: https://itep.org/tcja2018&2026/